arizona estate tax exemption 2020

Total assessed valuation in Arizona must not exceed 27498 for the 2020 tax year. Arizona offers a standard and itemized deduction for taxpayers.

Recent Changes To Estate Tax Law What S New For 2019

This means that homeowners can protect more of the equity in their homes.

. On may 31 2019 arizona governor doug ducey signed house bill 2757 into law. Because Arizona conforms to the federal law there is no longer an estate tax in Arizona after January 2005. First there is an exemption for widows widowers and totally disabled persons.

The current federal estate tax is currently around 40. Qualifying Widow er - 24400. Starting with the 2019 tax year Arizona allows a dependent credit instead of the dependent exemption.

For qualified people the exemption has the effect of reducing the assessed value of the real property by up to 3000 with a corresponding reduction in property tax. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. 31 2020 may be subject to an estate tax with an applicable exclusion amount of 11580000 increased from 114 million in 2019.

Tax Year 2019 Standard Deduction and Exemptions filed in 2020 Single - 12200. The top marginal rate remains 40 percent. For tax years prior to 2019 Arizona allowed dependent exemptions for persons that qualify as dependents on a federal tax return.

The current exemption doubled under the Tax Cuts. 25100 for married couples. Even though Arizona does not have its own estate tax the federal government still imposes its own tax.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. All estates in the United States that are worth more than 549 million as of 2017 are required to pay an estate tax. Final individual federal and state income tax returns each due by tax day of the year following the individuals death.

The exemption will be phased in as follows. The fair market value of these items is used not necessarily what you paid for them or what their values were when you. The federal inheritance tax exemption changes from time to time.

The Estate Tax is a tax on your right to transfer property at your death. Generally a person dying between Jan. The relief comes in several forms.

The districts estate tax exemption has dropped to 4 million for 2021. 1 2022 Arizonas homestead exemption will increase from 150000 to 250000. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023. But that doesnt leave you exempt from a number of other necessary tax filings like the following. The Internal Revenue Service announced today the official estate and gift tax limits for 2020.

Head of Household - 18350. Is The Exemption For My House Only. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

If the estate is worth less than the exemption amount no tax liability. The District of Columbia moved in the opposite direction lowering its estate tax exemption from 58 million to 4 million in 2021 but simultaneously dropping its bottom rate from 12 to 112 percent. If the taxpayer or spouse is legally blind andor born before January 2 1955 the following.

The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. The taxpayer or their spouse is blind. The exemption is applied to the real estate first then to a mobile home or an automobile.

The lifetime gift tax exemption for gifts made during 2020 is 11580000 increased from 114 million in 2019. And thanks to estate tax portability a married couple can now shield double that amount 2316. So the increase announced yesterday by the IRS means that if an estate is created ie if a person dies in 2020 there will be no estate tax imposed if the estate is worth less than 1158 million.

Personal Exemptions - ELIMINATED. Are Seniors in Arizona entitled to some property tax relief. Residents and nonresidents owning property there can rejoice.

While there is no Arizona inheritance tax law you may or may not be exempt from an inheritance tax based on the federal law. Starting in 2022 the exclusion amount will increase annually based on. What Are The Qualifications.

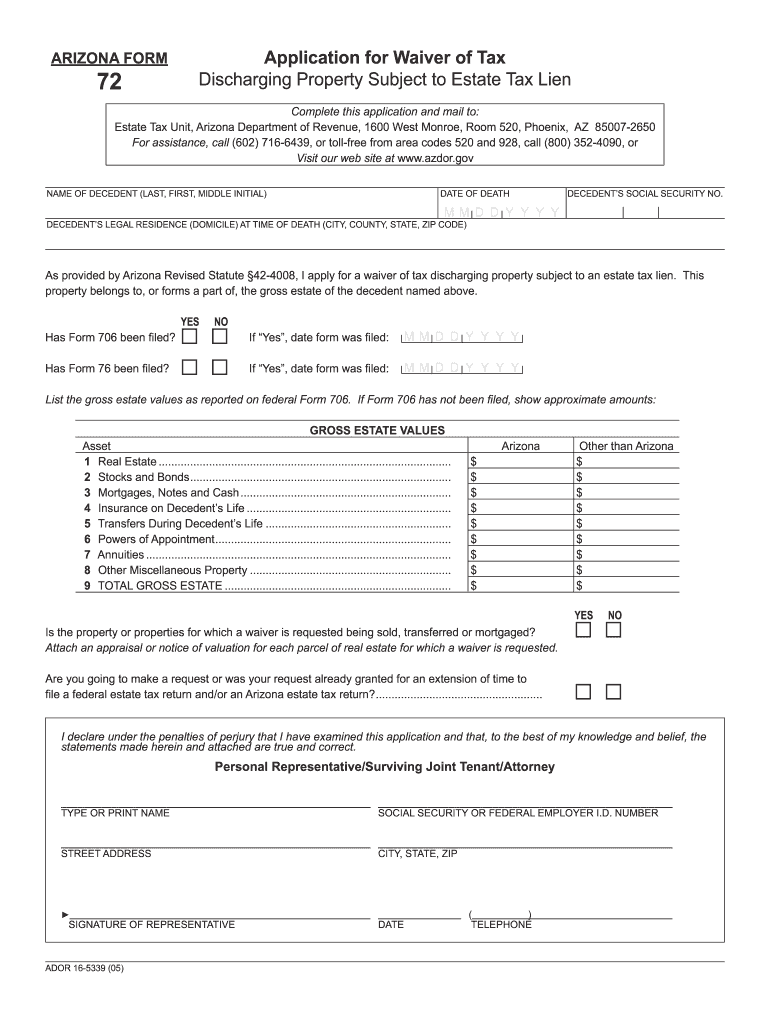

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. The size of the estate tax exemption meant that a mere 01 of estates filed an estate tax return in 2020 with only about 004 paying any tax. Arizona also allows exemptions for the following.

You must be a resident of Arizona. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. Married Filing Separate - 12200.

Federal law eliminated the state death tax credit effective January 1 2005. In 2020 the rates ranged from 12 to 16 percent but they now range from 112 to 16 percent. Married Filing Joint - 24400.

The estate and gift tax exemption is 1158 million per. No estate tax or inheritance tax. There are no inheritance taxes or estate taxes in Arizona.

The estate tax rate was adjusted so that the first dollars are taxed at a 9 rate which ultimately maxes out at 16. On May 31 2018 Connecticut changed its estate tax law to extend the phase-in of the exemption to 2023 to reflect the increase in the federal exemption to 10 million indexed for inflation in the 2017 Tax Act. The 2021 standard deduction is 12550 for single taxpayers or married filing separately.

The estate tax exemption was then increased in 200000 increments to reach 3 million in 2020. In 2020 it set at 11580000. This amount is indexed and changes each year.

Homestead exemption increase As of Jan. This exemption rate is subject to change due to inflation.

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Arizona State Taxes 2022 Tax Season Forbes Advisor

Estate And Gift Tax Update From The Tax Cuts And Jobs Act Braun Siler Kruzel Pc

Breaking Down The Oregon Estate Tax Southwest Portland Law Group

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Death Tax Hikes Loom Where Not To Die In 2021

Arizona Estate Tax Inheritance Tax Guide For 2020

New York S Death Tax The Case For Killing It Empire Center For Public Policy

What Are The Requirements For Property Tax Exemption In Arizona For Religious Organizations And Churches Provident Lawyers

Estate Tax Planning In Arizona Gilbert Az Estate Planning Law Firm

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Get And Sign Arizona Inheritance Tax Waiver Form

Estate Tax Planning In Arizona Inhertence Tax Plans Arizona Law Doctor

What Is The New Estate Tax Exemption For 2021 Phelps Laclair

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is The New Estate Tax Exemption For 2021 Phelps Laclair

Arizona Estate Planning Terms Definitions By My Az Lawyers

States With No Estate Tax Or Inheritance Tax Plan Where You Die